Wind energy is beginning a five-year boom across the United States. The main reason for the boom is that the federal Production Tax Credit (PTC) was renewed in 2015. The PTC is an incentive for commercial wind developers to construct new wind farms.

The PTC reduces federal income taxes for the owners of large wind energy projects. The amount of the credit depends on the output of the wind farm and the date it begins construction. The amount of the credit is currently $.023/kWh of electricity generated. The full value of the credit is available for 2016, and then it reduces down to 80% in 2017, 60% in 2018, and 40% in 2019. The credit percentages apply to the year that a project begins construction, so the credit will continue for projects completed by 2020.

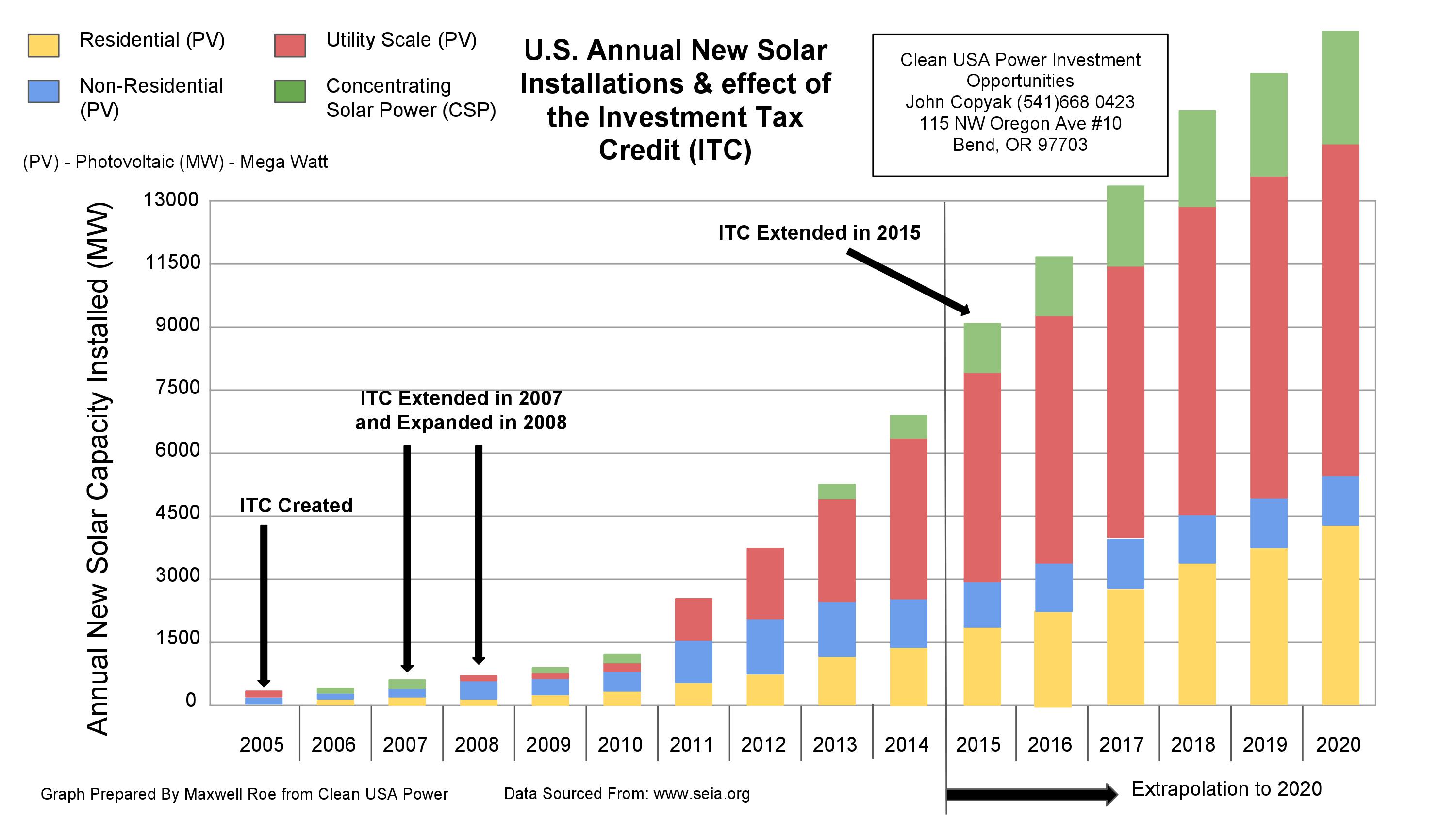

The PTC has been allowed to expire and then be renewed many times over the years. This expiration and renewal cycle has caused a very erratic building environment (see graph). Stability is critical in an industry that requires approximately three years to build each project. According to the graph, renewal of the PTC leads to a direct increase in development while the PTC is in place. Wind developers will be building rapidly in the next few years to take advantage of the most recent PTC renewal. The four-year extension is particularly beneficial over a one year extension because it allows developers to plan for the future.

2016 will be a good year for wind energy construction because there are permitted wind projects that have been waiting for the PTC to renew before starting construction. These projects have been in development for years, but will now qualify for the tax credit. Therefore, we won’t be waiting three years before seeing new construction. Now that congress has renewed the PTC, the commercial wind industry will be booming for then next five years!

Leave A Comment